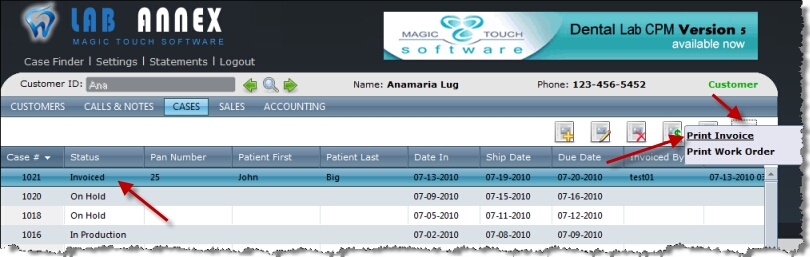

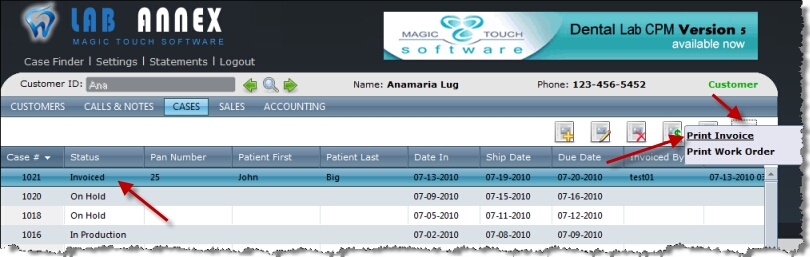

1. Select the case for which you want to print the Invoice. This case must be already Invoiced otherwise all you can print is the Work Order

Print Invoice

2. Click on Print icon.

3. Select Print Invoice

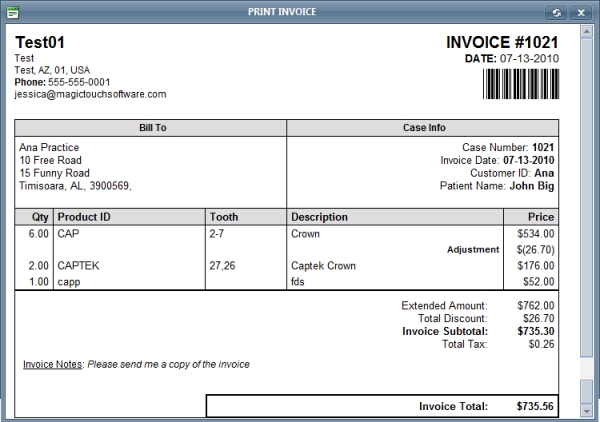

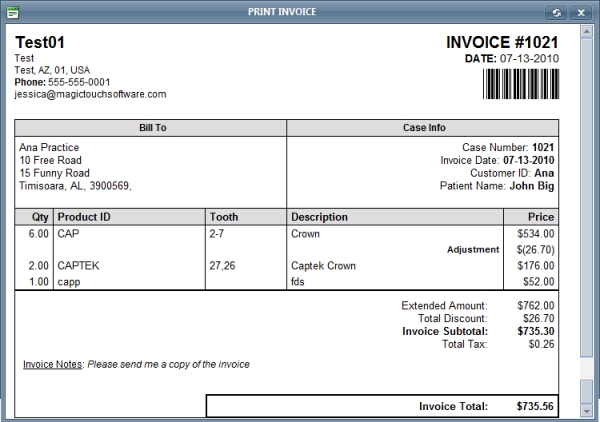

4. An Invoice will display following information:

| ► | User details like: Name, Address, Phone and email address |

| ► | Invoice Number is the same with the case number. Since case numbers are unique, the invoices will have the numbers of the invoiced cases. |

| ► | Date when the invoice was printed |

| ► | Bill to information with: Customer Practice Name and Address |

| ► | Case Info which includes: Case Number, Invoice Date, Customer ID, and Patient Name |

| ► | The list with the Products of this case. In this list there are several details like: Quantity, Product ID, Tooth number, Product's description and Price. Also if there are discounts for any products this will be listed under the product price as Adjustment. |

| ► | Invoice Notes if there were any, are displayed on the bottom of the page. |

| ► | Prices are calculated in this section like: |

| • | Extended amount - represent the total sum of all products prices. It is not subtracted the discount values from this sum. |

762.00$=534.00$+176.00$+52.00$

| • | Total Discount - represents to total discount value applied to all the products that have discount. In this case discount is applied to CAP product and it is 26.70$. |

| • | Invoice subtotal - is the value that results after subtracting Total Discount values from the Extended Amount.In our case: |

735.30$=762.00$-26.70$

| • | Total Tax - is calculated as a sum of the Sub totals of each product that is Taxable. To set the Taxable option to a product you have to go to Products form, select the product you need and check the Taxable option. In our case the only taxable product is capp and the Tax is 0.26$. |

| • | Invoice Total: The amount of dollars that are invoiced. It is calculates as sum of the Invoice Subtotal value and the Tax value that was applied: |

735.56$=735.30$+0.26$

Note: All amounts to be deducted are in brackets.

|